As a result, the balances are moving in the opposite direction than was intended, potentially making the business look more in debt than it is. Both can throw off your accounting and trigger a need to audit the books, an unnecessary time sink. The simplest error you can make with a journal entry is inputting the information incorrectly. The answers to questions about profitability, growth, debt, and more can all be found in financial statements and transaction histories.

Accounts Payable Journal Entry: A Complete Guide with Examples

Crafting a prudent payment schedule and prioritizing payments based on the due dates, discount opportunities, and supplier relationships is key to managing cash flows effectively. This system ensures that bookkeeping training certificate the accounting equation stays balanced, providing a clear picture of a company’s financial health. These entries are used to correct mistakes, make one-time changes, or record unusual payroll events.

Paying an invoice late

It is a short-term liability and in simpler terms total amount which is yet to be paid by the business to its creditors as per the purchase book. Large firms using ERP packages replace traditional purchase book with purchase ledger control account. Okay, now that we’ve worked out which accounts are affected and the impact on the basic accounting equation, let’s tackle the debit and credit journal entry. The final step is the reconciliation of the accounts payable account. The step will include reconciliation of outstanding dues and payments processed.

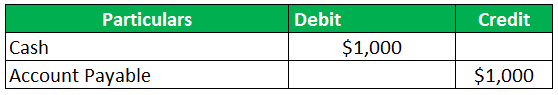

- Most of the time, a journal recording is based on a double-entry system.

- The crediting and debiting of each account negates any change in balance between the two transactions.

- It can be recorded against a transaction from an expense account to your accounts payable charge.

- Thus, accounts payable includes a comprehensive set of short-term debts of a company.

- This, in turn, lowers the risk of financial errors and boosts transparency and accountability in the organization’s financial reporting.

Accounts Payable (AP) FAQs

In double-entry accounting, you need to know whether a debit entry increases or decreases the value of an account. If the buyer maintains a purchases returns and allowances journal, then the goods returned by him would be recorded in that journal, rather than in the general journal. With the net method, if you pay your supplier within the agreed-upon time period, you’ll get a certain percentage of the discount. It’s essential that you to review your supplier contracts on a regular basis as it helps to prevent fraudulent billing practices, whether due to overpayment or duplicate payments.

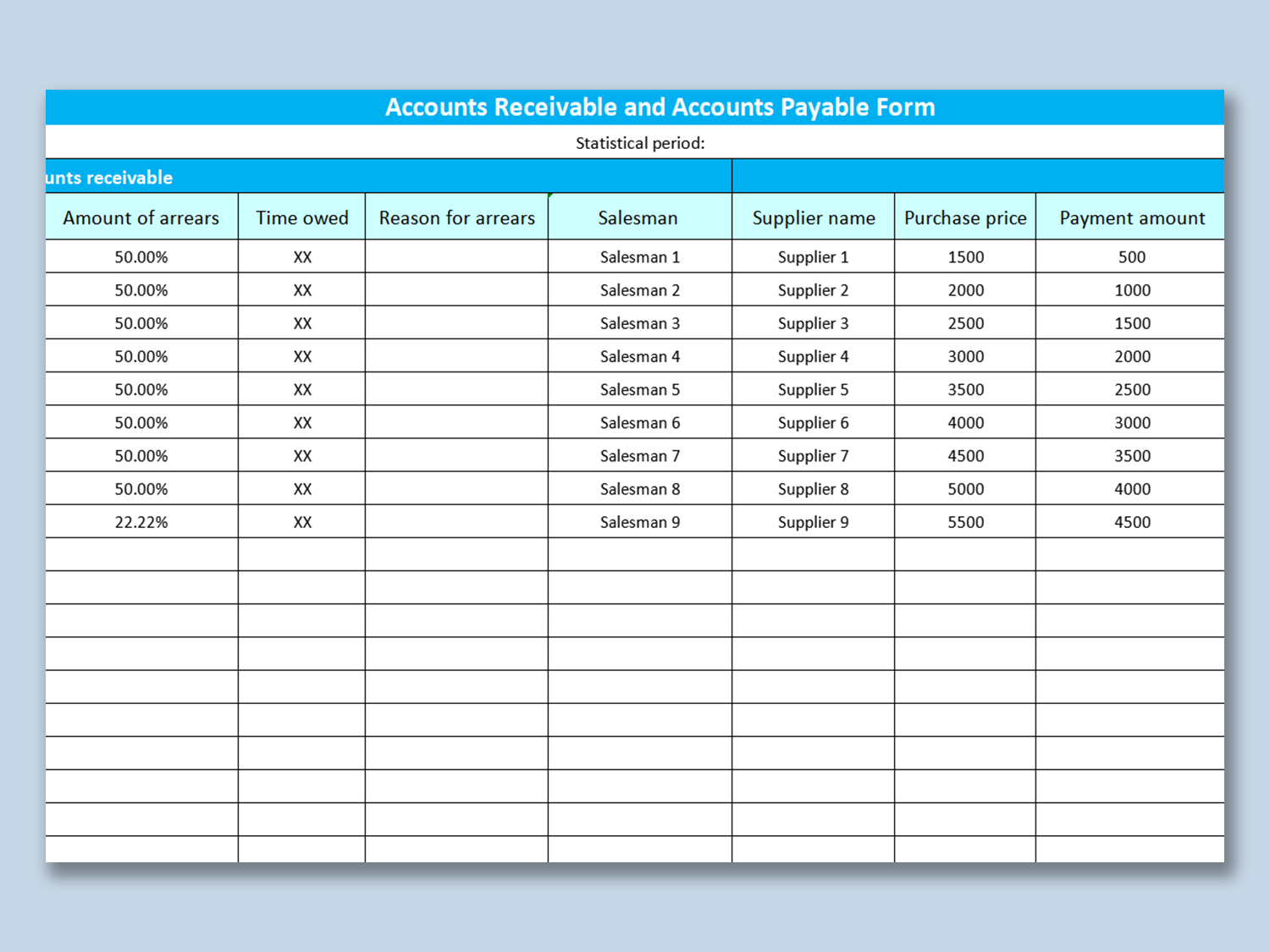

An aging schedule separates accounts payable balances, based on the number of days since the invoice was issued. Acme Manufacturing, for example, has $100,000 in payables from 0 to 30 days old, and $15,000 due in the 31-to-60-days-old category. Accounts payable turnover is the total purchases on credit divided by the average accounts payable balance. Timely and accurate payments help maintain strong relationships with your suppliers.

Services purchased on credit

The company received an invoice from the manufacturer after the delivery of raw materials on 24th August 2023. The invoice states that the outstanding amount of $150,000 will be paid to the vendor before the due date of 1st September 2023. Generally Accepted Accounting Principles (GAAP) provide a framework of standards, guidelines, and procedures for financial accounting and reporting. When it comes to accounts payable, adhering to GAAP ensures accuracy, consistency, and transparency in your financial records.

Likewise, the company can make the accounts payable journal entry by debiting the asset or expense account based on the type of goods it purchases and crediting the accounts payable. If accounts payable journal entries are not recorded correctly, it can lead to inaccurate financial statements, misrepresentation of liabilities, and incorrect financial analysis. It may also result in payment delays, strained supplier relationships, and difficulty in reconciling accounts. A journal entry for wages is a record of the gross pay earned by an employee during a pay period, before any deductions are taken out.

This journal entry shows ABC Ltd has increased raw materials by Rs 50,000 by debiting the raw materials account and increased its accounts payable balance by the same amount. This means ABC Ltd. owes its supplier Rs 50,000, which must be paid by 25th June. Any transaction related to purchasing goods or services on credit results in an accounts payable liability.

Below are some common situations wherein the accounts payable journal entries are to be maintained. We will learn them in details and gain valuable insight into the accounting system of payment made by companies. Whenever your petty cash accountant puts the money in the Petty cash fund they must make journal entries in your books.

Accurate bookkeeping is the foundation of any successful business, and payroll journal entries are a critical component of this process. The purpose of the journal entries expenses is to record accurately all the financial transactions. As it will help the business to maintain compliance with accounting standards and regulations. Journal entries questions and answers will help you to sort out revenue expenses in proper order.