The other half of the profits are considered retained earnings because this is the amount of earnings the company kept or retained. The retained earnings for a capital-intensive industry or a company in a growth period will generally be higher than those of some less-intensive or stable companies. This is due to the larger amount being redirected toward asset development. For example, a technology-based business may have higher asset development needs than a simple T-shirt manufacturer, due to the differences in the emphasis on new product development. Let’s say you’re preparing a statement of retained earnings for 2021.

To Ensure One Vote Per Person, Please Include the Following Info

A company’s management team always makes careful and judicious decisions when it comes to dividends and retained earnings. A statement of retained earnings consists of a few components and takes a series of steps to prepare. Businesses need to prepare a statement of retained earnings for both internal decision making and for the dissemination of information to external interested parties. If there are retained earnings, owners might use all of this capital to reinvest in the business and grow faster.

Which of these is most important for your financial advisor to have?

With retained earnings, equity members might lose out on dividends. Using this finance source too much can create dissatisfaction among members and impact the goodwill of the firm. A company shouldn’t avoid giving dividends payouts just to amass more retained earnings. And it can pinpoint what business owners can and can’t do in the future. They need to know how much return they’re getting on their investment. The statement of retained earnings paints a clear picture of that.

What type of account is a retained earnings account?

It’s crucial to remember that sales revenue, cost of goods sold, depreciation, and operating expenses—among other line items on your income statement—play a big part in shaping this number. Non-cash items like write-downs, impairments, and stock-based compensation are the behind-the-scenes crew that also influence the plot. Your net income—or net loss, if the winds didn’t blow favorably—is the figure you’ll blend into the mix.

Also, a company that is not using its retained earnings effectively is more likely to take on additional debt or issue new equity shares to finance growth. Companies can distribute cash to shareholders in the form of dividends. When companies pay cash dividends, they treat it as a cash outflow and record the impact in the cash flow from financing section of the cash flow statement. The payment of dividends will impact both the cash and retained earnings items on the balance sheet. The dividends payment causes cash to decrease with a corresponding decrease to the earnings (equity). A company reports retained earnings on a balance sheet under the shareholders equity section.

- This isn’t just accounting; it’s strategic communication that reinforces shareholder confidence and underscores the company’s potential.

- Net income that is not included in accumulated retained earnings has been paid out to shareholders as dividends.

- The third line should present the schedule’s preparation date as « For the Year Ended XXXXX. » For the word « year, » any accounting time period can be entered, such as month, quarter, or year.

- When you subtract dividends from your net income, you’re essentially closing the loop of your retained earnings calculation.

Traders who look for short-term gains may also prefer getting dividend payments that offer instant gains. Dividends are paid out from profits, and so reduce retained earnings for the company. A statement of retained earnings shows changes in retained earnings over time, typically one year. Retained earnings are profits not paid out to shareholders as dividends; that is, they are the profits the company has retained. Retained earnings increase when profits increase; they fall when profits fall.

A second situation in which an adjustment can be entered directly in the RE account and, in this way, bypass the income statement is in the context of quasi-reorganization. In reality, the purchase will have depleted the available cash in the company. As a result, the firm will be less able to pay a dividend than before the purchase was accomplished. Accracy is not a public accounting firm and does not provide services that would require a license to practice public accountancy.

The Income Statement shows the company’s profit and loss over a specific period, and retained earnings can be calculated from this information. Retained earnings reflect the cumulative amount of net income a company has retained over time, after distributing dividends. It’s a measure of the company’s total profit that’s been reinvested back into the business, rather than paid out to shareholders. This step is a testament to the financial decisions made over the period.

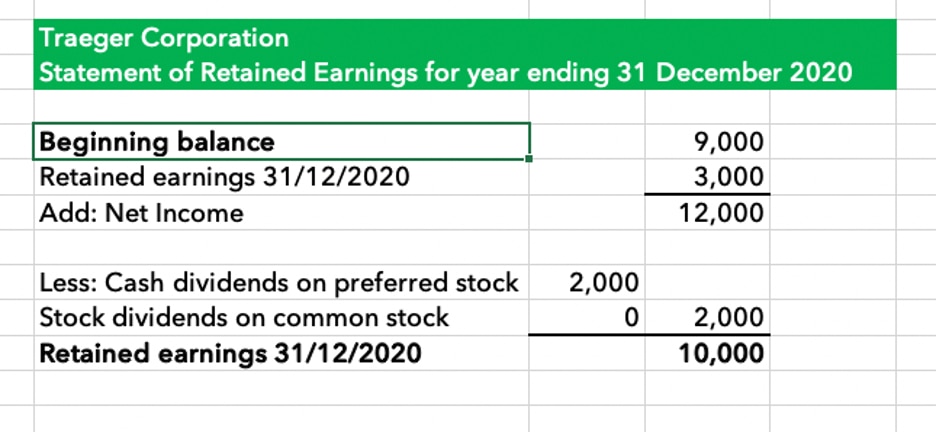

It begins with the balance of retained earnings at the beginning of the period and adjusts for net income or loss generated during the period. A negative retained earnings balance signals that a company has accrued more losses or paid more dividends than it has earned. It’s often an alert to investors and managers to review the company’s financial health and strategies. Retained Earnings are listed on a balance sheet under the shareholder’s equity section at the end of each accounting period.

The Net Income (Net Loss) and dividends are paid below for the years 20X6-20X9. What exactly is that accumulated depreciation account on your balance sheet? Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial what happens if you file taxes a day late management and make informed business decisions. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. A statement of retained earnings can be extremely simple or very detailed.

It serves as a clear indicator of a company’s financial health and indicates how much profit has been kept on the books over a specific period. This statement can signal either growth potential or a warning bell of upcoming financial troubles, making it a crucial document for investors, shareholders, and directors alike. They use it as a yardstick to measure the company’s prosperity and strategic financial decisions over time.